- #Record a shipping loss in quickbooks enterprise 2019 how to#

- #Record a shipping loss in quickbooks enterprise 2019 update#

- #Record a shipping loss in quickbooks enterprise 2019 full#

- #Record a shipping loss in quickbooks enterprise 2019 software#

If you face any kind of technical glitches while using this accounting software. It also assists you in running small as well as mid-sized businesses.

#Record a shipping loss in quickbooks enterprise 2019 software#

Undoubtedly, QuickBooks is the most popular accounting software that is convenient for both desktop or online support. We care for our customer’s hopes and to fulfill them, our ProAdvisers works well for QuickBooks users. ProAdvisors is an excellent and certified person who provides the premium QuickBooks help service to resolve problems and technical glitches that occur in your accountant management software. If you seek our instant support or assistance for the QuickBooks errors, dial the toll-free QuickBooks support number.

#Record a shipping loss in quickbooks enterprise 2019 update#

#Record a shipping loss in quickbooks enterprise 2019 full#

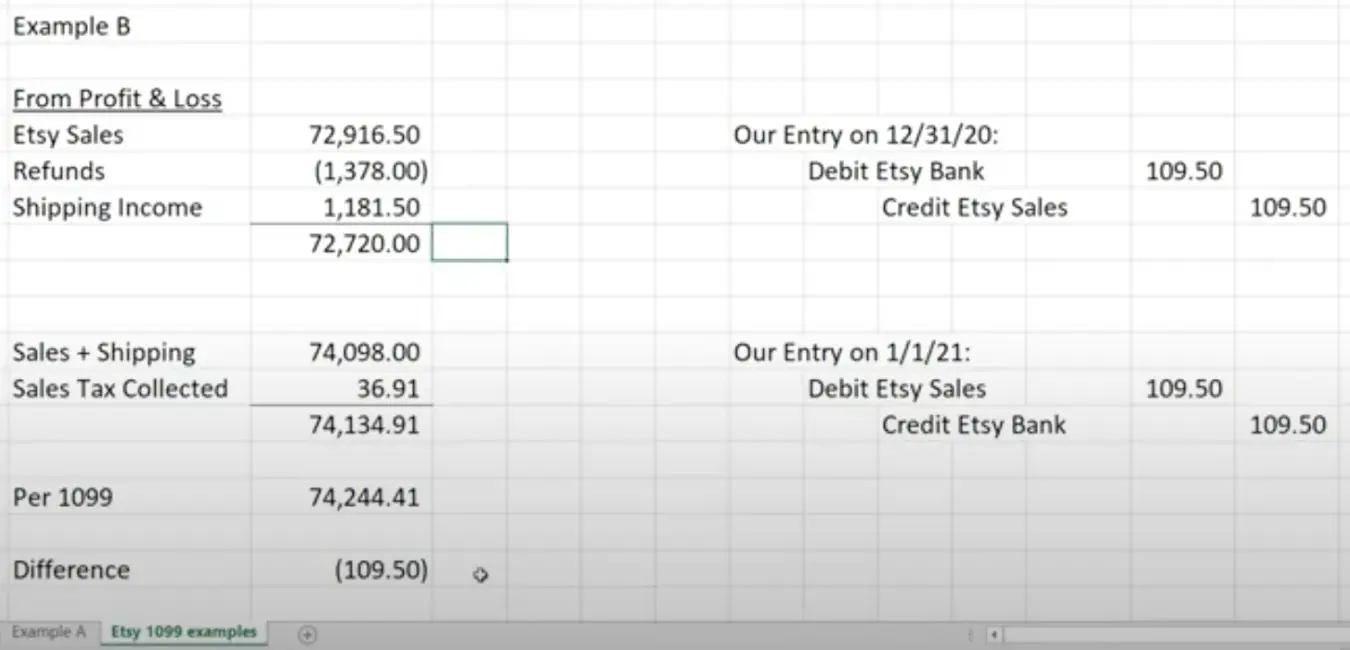

On the Discount tab, make sure to enter the bad debt amount in the Amount of Discount field.Highlight the line item that will not be paid.First, go to the Customers menu and choose Receive Payments.

However, if you want to show it only as an expense in the Profit and Loss report, simply use the Discounts and Credits button to increase the balance in your bad debt account and decrease your net profit by the amount of the unpaid invoice. Since a credit memo was applied to the invoice, it'll show as an income and expense in the Profit and Loss report to offset the amount. Thanks for coming to the Community, cgonzalez.īad debt is an income that won't be paid anymore.

#Record a shipping loss in quickbooks enterprise 2019 how to#

I'm just a post away if you should have any other questions about how to write off bad debt. Select your QuickBooks for Windows version.Customize reports in QuickBooks DesktopĪlso, The phone support agents will be able to assist you in getting this resolved.Record a credit memo or refund in QuickBooks Desktop.On the Apply Credit to Invoices window, select the transaction.Īfter that, you can run a Cash Basis Profit & Loss Detail report to make sure the total is 0.įor more details, please check the articles below:.On the Available Credit window, select Apply to an invoice.Enter the items, then select Save & Close.

0 kommentar(er)

0 kommentar(er)